Targeting Gaza’s Banking Sector: A Calculated Act of Genocide

Depleted Liquidity, Devalued Currencies, and Less Than Five ATMs Serving the Entire Gaza Strip, bespeak how Gaza’s financial system is crumbling under a persistent genocidal onslaught.

In less than two years of relentless Israeli genocide, Gazans have devised new patterns of buying, selling, and financial exchange amid a vanishing banking infrastructure. But how and when did this financial crisis erupt? Where does money come from, where is it spent, and how did Gaza’s Palestinian banking assets disappear after nearly 600 days of ongoing aggression? Who are the main actors driving this crisis, and have any efforts to overcome it yielded meaningful results?

Financial Siege Warfare: The Banking System on the Genocidal Frontline

From the first hours of the genocidal assault on Gaza, banks and governmental institutions shut down operations as the Israeli Air Force unleashed unprecedented aerial bombardments across neighbourhoods, official facilities, and private infrastructure throughout Gaza.

Reports later revealed that Israeli Prime Minister Benjamin Netanyahu instructed former Chief of Staff Herzi Halevi to escalate the bombing campaign into relentless waves targeting everything indiscriminately—disregarding pre-approved military target lists. The bombardments decimated critical infrastructure, including roads, communication networks, energy grids, and internet services, forcing widespread closures of institutions to protect their employees. Only hospitals, security, and civil defense centers operated under emergency protocols.

With banks closed, ATMs became the sole financial lifeline for Gaza’s population. However, the relentless airstrikes damaged or destroyed most ATMs, pushing Gaza into its first wave of financial collapse.

The subsequent Israeli ground invasion severed northern Gaza and Gaza City from southern and central areas, focusing military operations on the city center. Systematic raids and airstrikes targeted financial institutions, official bodies, and currency exchange offices. These incursions culminated in massive looting of funds, explicitly aimed at crippling Gaza’s financial infrastructure. Among the most notorious acts was the raid on the main Palestine Bank branch in Al-Rimal neighbourhood, where approximately 200 million shekels (over $54 million) were seized by the Israeli occupation forces.

By the end of the first month of aggression, Gaza had descended into suffocating financial isolation. Banks and money transfer offices across Gaza and northern regions were completely shut, causing severe cash shortages among residents. Communication and internet outages further crippled operations of exchange offices even in the south and central Gaza, preventing many families from receiving aid and remittances from abroad.

What Are Gaza’s Current Sources of Money?

Since the banking system collapsed in late 2023, Gazans have been left with only four options to secure funds:

- Personal Savings (Cash or Bank Accounts):

For thousands of families, savings were the only fallback during the early months of the assault. But skyrocketing prices for food, housing rents, and other essentials rapidly drained these reserves. Accessing bank accounts was nearly impossible due to ATM shutdowns and a brutal cash liquidity crisis fuelled by Israeli restrictions on money entering Gaza. - Public Sector and Pension Salaries:

With commerce halted, private sector jobs lost, and remote work with Arab or international entities disrupted, tens of thousands of Gazan workers lost their income streams. Thus, salaries paid by the Palestinian Authority to government employees and retirees became the only financial lifeline for many families. Yet, ongoing hostilities and the PA’s financial woes caused these payments to be made in partial, delayed instalments, forcing desperate citizens to queue for days at the few functioning ATMs in southern and central Gaza to withdraw what little they could. - Cash Assistance from Aid Organizations:

International and humanitarian agencies such as UNRWA, UNICEF, Catholic Relief Services, and Norwegian Refugee Council intermittently provided small cash grants to limited groups, including the needy, orphans, and vulnerable social categories, mainly in displacement camps. - Remittances from Gazan Diaspora:

Remarkably, Gazan expatriates have mobilized to support their families through a complex web of informal and formal channels—money transfer offices, financial apps, and global companies like Western Union and MoneyGram. Yet, these services have severely contracted due to liquidity shortages and communication blackouts.

How Are Gazans Managing Their Finances Today?

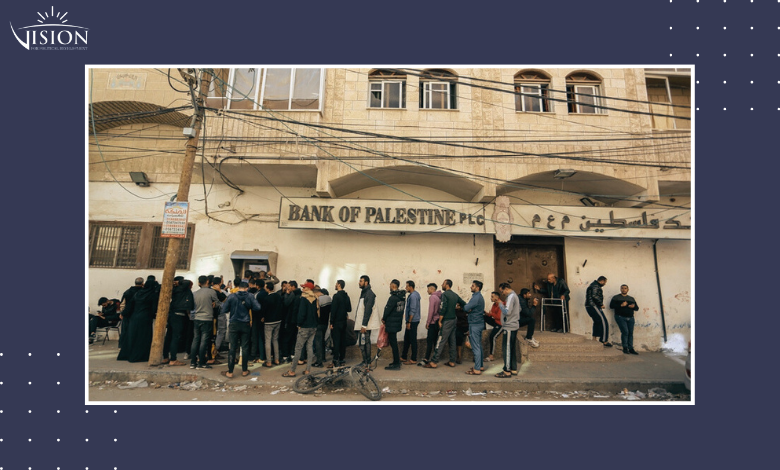

Currently, Gaza relies on just three operational ATMs for cash withdrawals from bank accounts, whether from external remittances or salary payments. This scarcity causes extreme overcrowding, with lines stretching hundreds of meters and family members taking shifts for days on end. Frequent ATM outages, cash shortages, and imposed withdrawal limits further restrict access to cash.

Alongside this, informal groups impose extortion fees on citizens seeking to use ATMs, charging commissions or even draining machines to provide cash directly—skimming a cut from withdrawals.

Sending remittances to Gaza is increasingly fraught. Initially, international money transfer firms facilitated this flow, but with rising costs, many turned to local exchange offices in Turkey and Egypt, which impose exorbitant fees—sometimes up to 30% of the sent amount. These offices also manipulate currency exchange rates, often offering less than the official Palestinian market price. Additionally, the Israeli offensive and occupation’s control over crossings have shuttered many offices, further disrupting money flows.

Emerging Coping Mechanisms Amid Crisis

Faced with collapsing liquidity, Gazans have devised alternative financial strategies, including:

- “Takyesh” (Preloading) Balances via Merchants: Using credit card payments at shops and receiving cash in return, with commission fees between 5% and 25%.

- Using Payment Machines in Street Markets to bypass cash shortages.

- Mobile Banking Apps for Transfers, despite fluctuating fees and unreliable cash availability.

- Informal money transfer groups operating via messaging apps, some succeeding in delivering funds at high costs, others relying on arrangements with local merchants to exchange cash outside Gaza.

Where Did the Money Go?

Israeli-imposed restrictions on cash inflows have rendered all coping attempts inadequate. Exchange offices closed, ATMs drained and partially functioning through merchant deposits, while Gaza’s financial crisis deepens—worst in Gaza City and northern areas. The ground invasion and occupation’s presence at key points have thwarted individual efforts to move money across divided zones, which had briefly succeeded early on.

Compounding the liquidity crisis is the deterioration of currency notes—merchants refusing to accept worn bills or small denominations (5 and 10 shekels), turning tens of thousands of shekels into worthless paper, unusable for basic purchases until banks reopen.

It is also vital to note the ongoing financial drain since the start of the conflict. From October 2023 to May 2024, exorbitant fees charged by smugglers and brokers for passage through Rafah crossing drained Gaza’s hard currency reserves, sometimes costing individuals tens of thousands of dollars each.

Rampant price inflation and the rise of black markets for fuel, food, aid, and daily essentials have also siphoned off large portions of the scarce cash supply into the hands of war profiteers and black-market operators.

Conclusion

Discussing Gaza’s financial devastation might seem secondary amidst the daily horrors of indiscriminate killing, destruction, starvation, siege, and forced displacement. Yet behind the brutal headlines lie countless critical details often overlooked—the liquidity crisis, shattered infrastructure, collapsing public and private sectors, and their direct impact on the daily lives of Gazans under continuous attack.

Despite these staggering challenges, Gazans have innovated survival strategies, striving to manage despite relentless adversity. Yet the fundamental question remains: What role will Palestinian public institutions—especially the Palestinian Monetary Authority, Ministry of Finance, banks, and diaspora organizations—play in breaking this financial siege?

With over two million people enduring a second consecutive year of relentless bombardment, the imperative for coordinated intervention and support to preserve Gaza’s economic resilience has never been more urgent. Concerted efforts from Palestinian authorities, international stakeholders, and financial institutions are the only hope—before the lifeline of an entire population is irreparably severed. To break this crippling financial siege, the time for coordinated action is ‘now’.

NOTE: This text is adapted from original Arabic article.